We have three key commentaries to rely on to forecast the year ahead; Domain’s 2026 Property Forecast, the SQM Research 2026 Boom & Bust Report, and some interesting highlights from property voice Michael Matusik. I’ve summarised key points so and thrown in some of my own perspective based on behaviours and trends within our buyer pool. If you’d like to read the full reports i’ve included links at the bottom of this article.

What moves the market? Interest rates (economy/inflation/employment) , Supply (construction), Demand (immigration), and Govt stimulus.

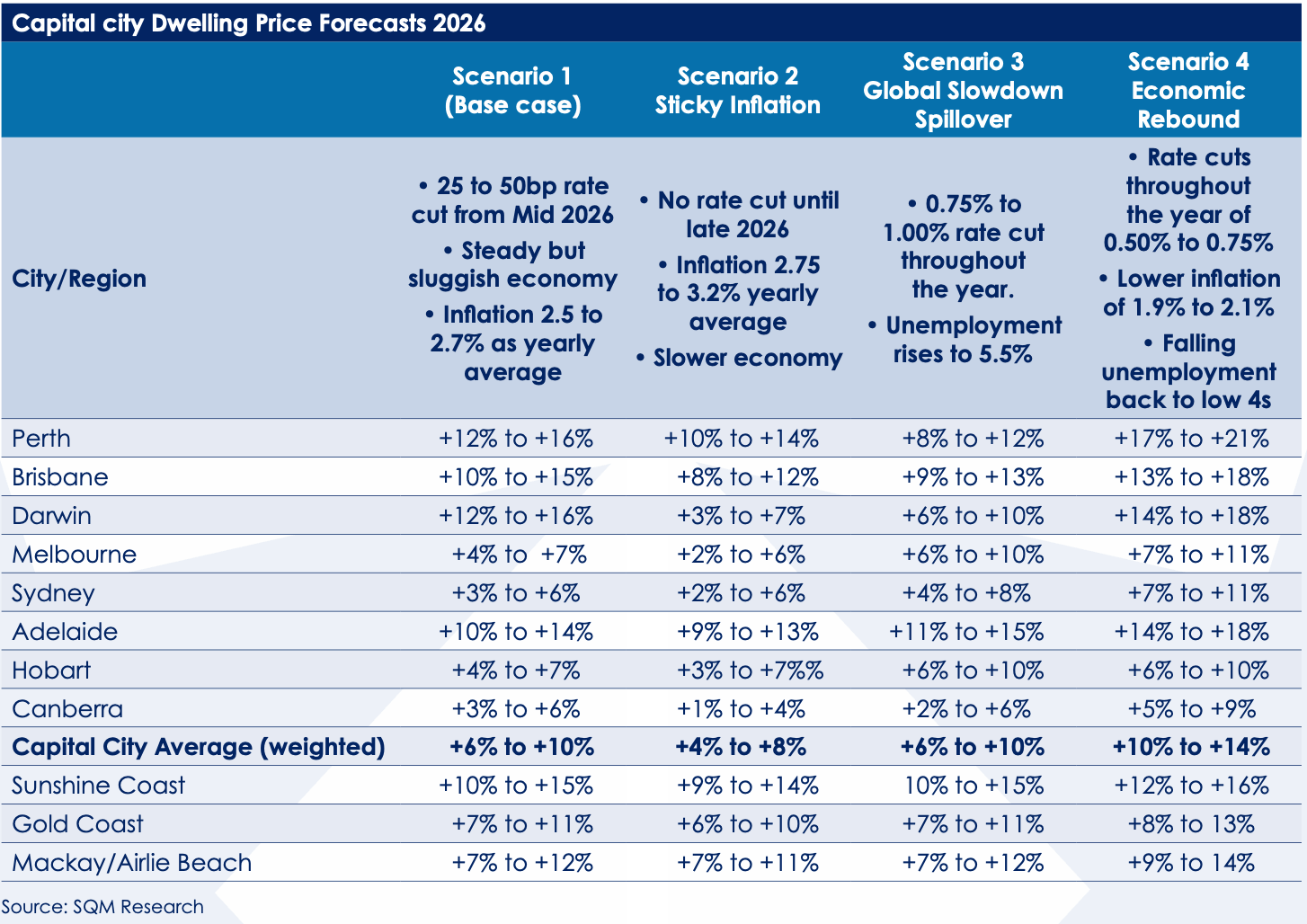

Here are SQM Research’s Capital City scenarios which account for rates and economic data as key drivers.

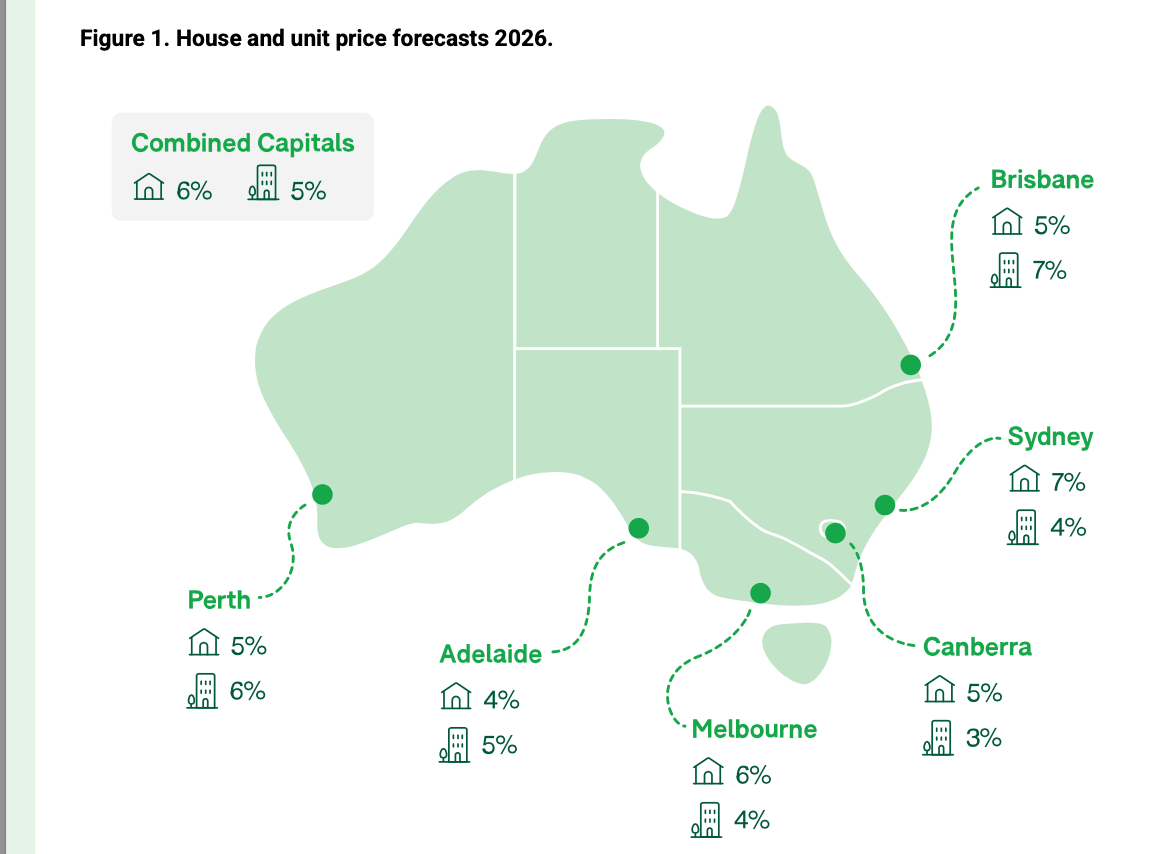

And here’s the Domain Report forecast:

Building approvals and starts nationally were down in 2025 however they are forecast to increase by 6% this year. Industry forecasts suggest multi-unit starts lift meaningfully from this year, rising from around 70,000 commencements last year up to 100,000 by 2030. I support the idea that apartment prices will perform well (especially three bedders) thanks to a continued tight rental market, and affordability.

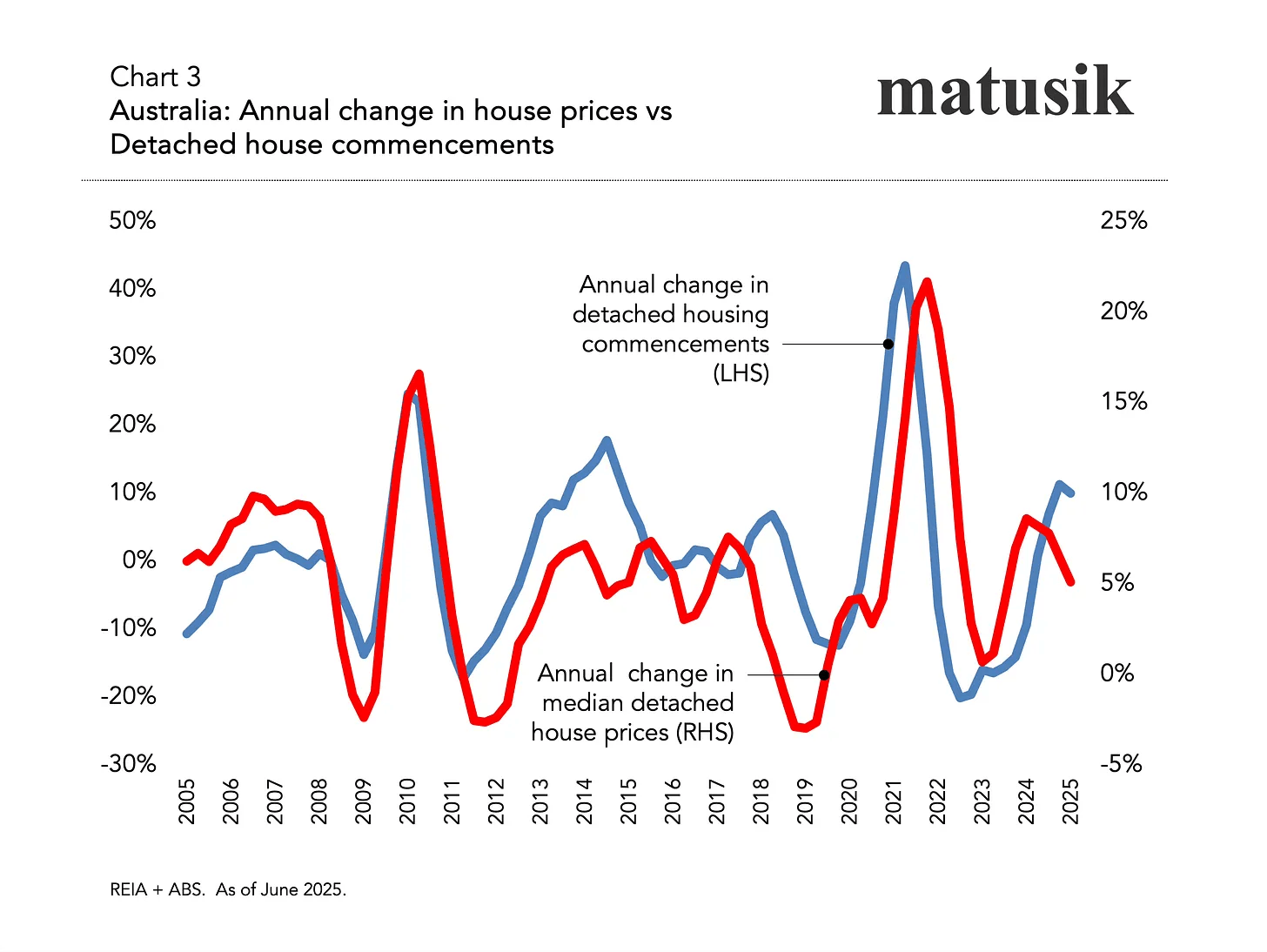

Conventional wisdom says an increase in housing supply moderates prices. Property commentator Michael Matusik believes this is a myth. His theory is that in an average year our building completions only add 1.5 to 2% to a total stock pool of 11.5M homes which is not enough to move the needle. Matusik reckons an increase in housing starts pushes house prices up as the rising cost of construction means homes must be sold for higher prices to meet margin and more stock (liquidity) creates a healthier market. He has the chart to back his claim, see below. If he’s right the forecast addition of stock will fuel prices this year.

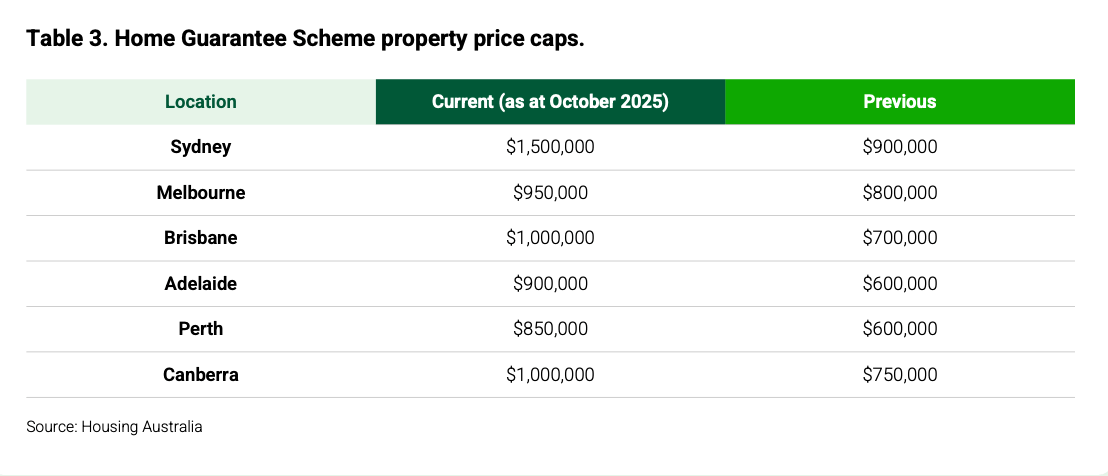

An emerging driver of demand last year was first home buyers taking advantage of the Government 5% deposit scheme which commenced October 1st. This has been the most active cohort on our books and new enquiry remains high. There is consensus that the first home buyer category will be hot in 2026 and stock in this category up to the limits of the scheme (varies by area) should outperform even if rates do rise.

Australia’s population growth is forecast at 1.6% for 2026 with roughly 75% of that supplied by immigration (340,000). A lacklustre economic outlook balanced out by reasonably low employment levels means it is unlikely for immigration quotas to be reduced any time soon.

2025 saw a big uptick in investor activity with investor lending growing 3x faster than owner-occ lending, especially in Vic and NSW. We are experiencing a surge in “hybrid briefs”, homebuyers wanting a property to live in for 1-2 years that will then convert to an investment. First time buyers are increasingly prepared to re-locate to an affordable middle/outer ring suburb to get onto the property ladder and the lines between investment and owner occ are getting blurry indeed.

We also anticipate that initiatives like the NSW Housing Pattern book and Futureplan Vic will accelerate gentle density and the rise in popularity of infill property typologies. We are seeing increased development in TOD and LMR areas and buyer interest and appetite for duplexes terraces and townhouses is increasing.

If you’d like to read the full reports referenced by the above you can do so here: